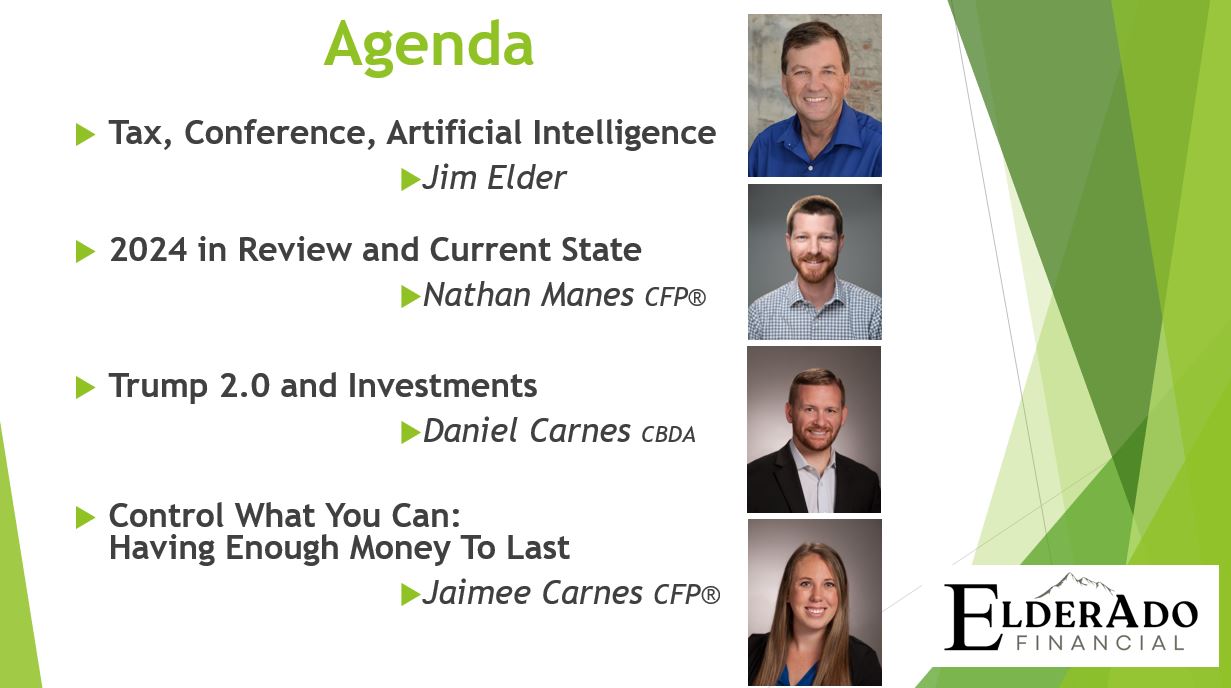

Market Update Seminar Replay

Tune in to hear a recap of our heavily attended Spring 2025 Seminar. Jim speaks about tax form updates, our DOGE, Artificial Intelligence, and shares some management fee comparisons. Nathan, our newest Certified Financial Planner(R), discusses a review of 2024, current economic conditions, and ...

How to Financially Prepare for a Natural Disaster

At ElderAdo Financial, we are more than just your fiduciary financial advisors—we are your partners in safeguarding your financial well-being. Natural disasters can strike unexpectedly, disrupting lives and finances alike. While we cannot predict when or where disasters will occur, we can take proactive steps ...

Euphoria & Despondency = Danger

At this point we are several weeks removed from the 2024 U.S. presidential election. Since election night I have been observing the reaction to the election results and as you can imagine, one side is super excited and the other not so much. Is so ...

Financial Cliff Diving: How Seasoned Advisors Know When to Jump

In the beautiful and thrilling setting of Acapulco, Mexico, cliff divers leap from dizzying heights into the ocean below, creating breathtaking performances of courage and precision. With their practiced eyes and deep knowledge of the cliffs, currents, and tides, these divers know exactly when to ...

Fall 2024 Economic and Market Update Seminar Replay

Tune in to hear a recap of our heavily attended Fall 2024 Seminar. Jim speaks about our building progress, our open house, the importance of a fiduciary, and sheds some perspective on how things have progressed over the years. Nathan discusses a review of 2024 ...

Is Splitting Your Assets Evenly for Your Beneficiaries the Best Option?

As financial advisors, we understand that estate planning is one of the most personal and significant decisions you will make. Many people assume that dividing assets equally among beneficiaries is the fairest way to distribute their estate. While this approach may seem straightforward, it often ...

Smart Ways to Save More Money Each Month

Saving more each month is a common goal many of us strive for. Whether you’re preparing for a comfortable retirement, building an emergency fund, or simply aiming to increase your financial security, small changes in your habits can have a big impact over time. Here ...

Enjoying Your Retirement Without Financial Stress

Retirement is a significant milestone that brings with it the promise of relaxation, leisure, and the freedom to pursue passions you might have set aside during your working years. However, for many retirees, the idea of living without a steady paycheck can cause anxiety about ...

Safeguarding Your Finances After the Recent Social Security Breach

In light of the recent breach involving Social Security numbers, we want to address some important concerns and provide guidance on how you can protect yourself and your financial well-being. The security of your personal and financial information is always a top priority for us. ...

Navigating Financial Planning During a Terminal Illness Diagnosis

When a loved one receives a terminal illness diagnosis, the emotional and physical toll can be overwhelming. During this challenging time, addressing financial matters may be the last thing on your mind. However, having a solid financial plan can provide peace of mind and allow ...

Stay Safe from Cryptocurrency Scams

Cryptocurrencies have taken the world by storm, offering new opportunities for investment and innovation. However, with these opportunities come risks, particularly the risk of scams. As your trusted financial advisors, we want to ensure you're well-informed and protected. Here are some common cryptocurrency scams to ...

Spotting Scams: Protecting Yourself and Your Finances

In today's digital age, scams are becoming increasingly sophisticated, targeting individuals of all ages and financial backgrounds. As your trusted financial advisors, we want to ensure you have the knowledge to protect yourself and your finances. Here are some key tips to help you spot ...

The Power of a Financial Plan

As your trusted advisors, we want to emphasize the importance of financial planning in securing your future and achieving your long-term goals. Financial planning is not just about managing your investments; it's a comprehensive strategy tailored to your unique circumstances, goals, and risk tolerance. At ...

Money Tips From The Wealthy

In the pursuit of financial success, it's valuable to learn from those who have already achieved it. Here are some insightful money tips gleaned from millionaires that can help guide your financial journey: Live Below Your Means: Prioritize saving and discernment in spending. This allows ...

8 Healthy Financial Habits

By creating healthy financial habits, you can help reduce financial stress, increase financial security, and enhance peace of mind. Here are eight important habits to help you rest easy with the knowledge that you are financially secure. 1. Live Within Your Means Spending less than ...

The Crucial Role of A Certified Financial Planner(R) in Achieving Financial Success

In an era of complex financial markets and an abundance of investment options, navigating the path to financial success can be a daunting task. You may find yourself grappling with decisions related to investments, retirement planning, tax strategies, and more. In such a challenging landscape, ...

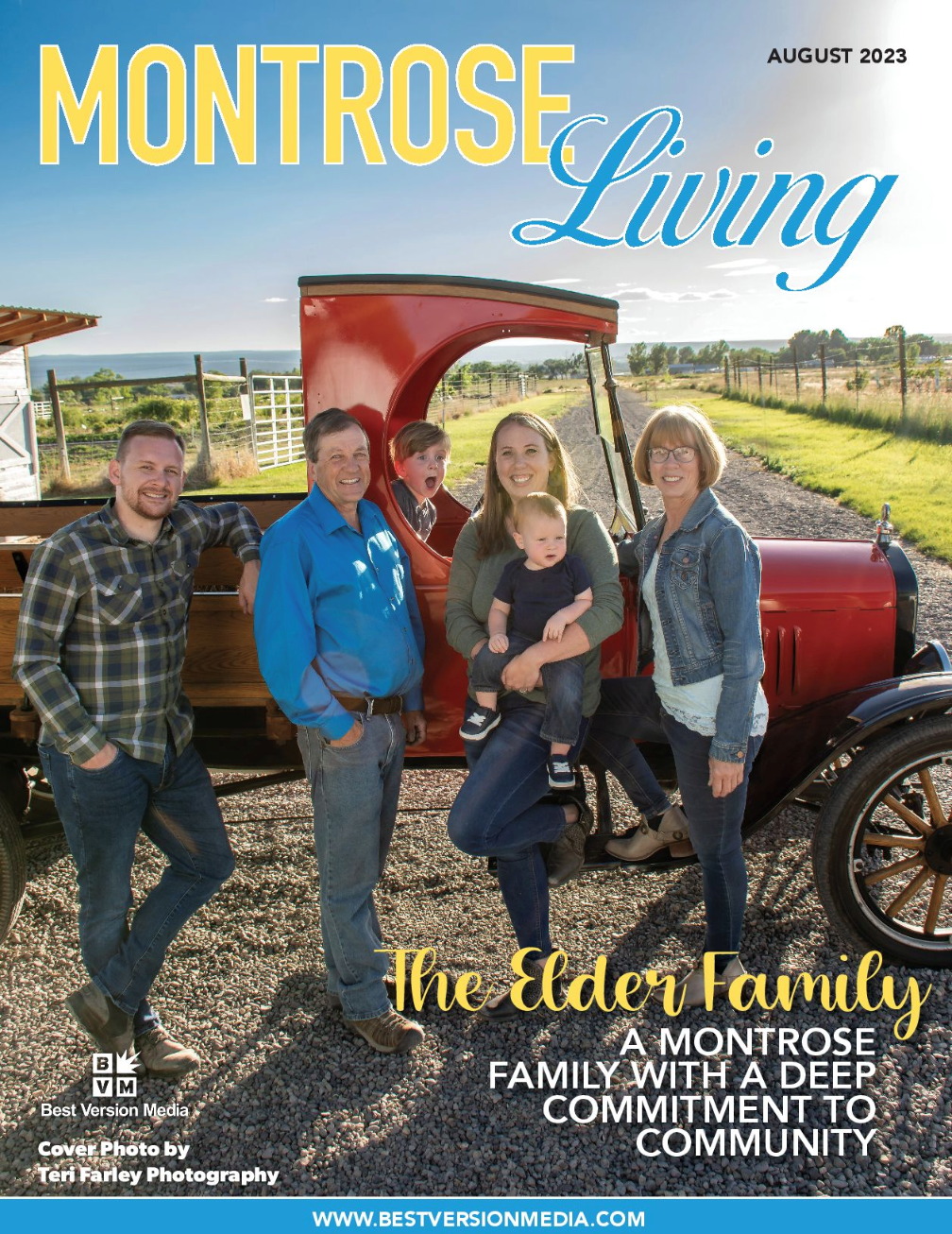

The Elder Family by Montrose Living

Thank you, Montrose Living for publishing this article on The Elder Family!

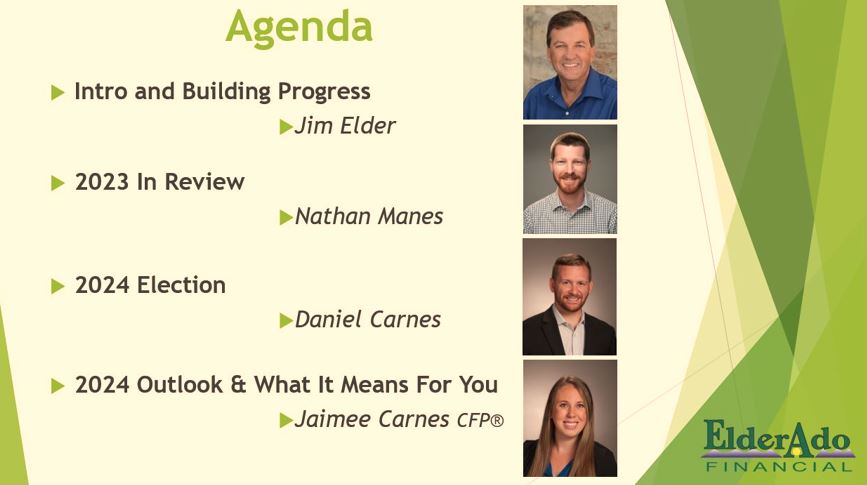

January 2024 Economic and Market Update

Tune in to hear founder, Jim Elder, share updates about ElderAdo's new building and a few items about Charles Schwab. Nathan Manes, one of our financial advisors, shared about what happened in 2023 including major events, interest rates, market recap, Bitcoin, managing emotions, ...